Rupert Grint's tax bill has made headlines, and not for any small sum. The "Harry Potter" star, beloved for his role as Ron Weasley, is facing a staggering $2.3 million tax payment after losing a battle with British tax authorities. It is a dramatic turn of events for an actor who once brought a lovable wizard to life on screen. The case revolves around an alleged misstep in classifying his residual payments from the "Harry Potter" franchise. This seemingly technical issue has ballooned into a legal and financial headache for the star. Here is what happened, why it matters, and how it connects to tax loopholes dating back to The Beatles. What Is Behind Rupert Grint's Tax Bill? Rupert Grint’s tax bill stems from a 2012 tax return, where he...

next aeticle

Rupert Grint's tax bill has made headlines, and not for any small sum. The "Harry Potter" star, beloved for his role as Ron Weasley, is facing a staggering $2.3 million tax payment after losing a battle with British tax authorities. It is a dramatic turn of events for an actor who once brought a lovable wizard to life on screen.

The case revolves around an alleged misstep in classifying his residual payments from the "Harry Potter" franchise. This seemingly technical issue has ballooned into a legal and financial headache for the star. Here is what happened, why it matters, and how it connects to tax loopholes dating back to The Beatles.

What Is Behind Rupert Grint's Tax Bill?

Rupert Grint’s tax bill stems from a 2012 tax return, where he categorized $4.5 million in residual earnings from Harry Potter DVDs, TV syndications, and streaming rights as a “capital asset.” This classification, while clever, meant a lower tax rate. In the UK, capital assets are taxed more leniently than regular income.

However, the British tax authority, His Majesty's Revenue and Customs (HMRC), didn’t agree with this interpretation.

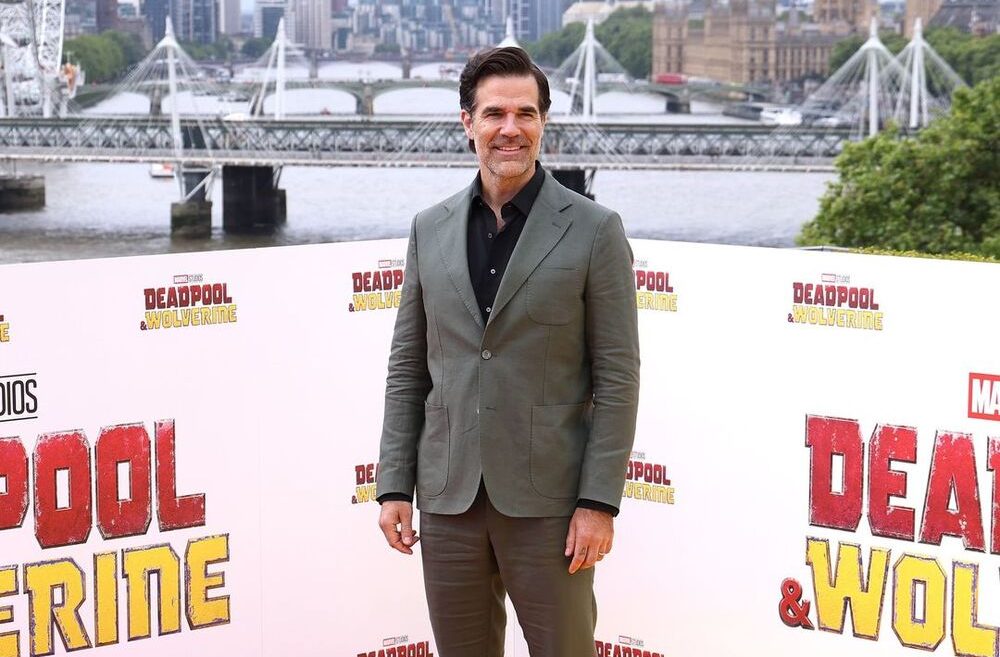

Marca / HMRC argued that the income was directly tied to Grint’s professional activities and should be taxed at the higher income rate.

After years of investigation, the court sided with HMRC, comparing Grint’s case to a tax strategy famously used by The Beatles in the 1960s.

The "Beatles Clause" and Tax Loopholes

The "Beatles clause" adds an intriguing layer to Rupert Grint’s tax bill. This nickname refers to a financial loophole exploited by the iconic band decades ago. The Beatles formed a company and sold the rights to their music catalog, declaring it as a capital gain rather than income. It was a bold move but didn’t sit well with tax authorities then - and apparently, not now.

Grint’s lawyers argued that his strategy was lawful, emphasizing that he had sold his residual rights to a company he created, Clay 10 Limited. Yet the tribunal judge ruled otherwise. The judge pointed out that the value of these rights “derived substantially” from Grint’s personal performances in the Harry Potter films.

In short, it was not a separate capital investment. It was earnings from his work as an actor.

Rupert Grint's Role in His Financial Decisions

One of the surprising revelations from this case is how little involvement Rupert Grint had in his financial matters. Grint testified that he left most decisions to his father and professional accountants. Judge Harriet Morgan acknowledged this, noting that the actor placed significant trust in his family and advisors to handle his finances.

GTN / While this defense might evoke some sympathy, the court maintained that Grint’s lack of direct oversight didn’t absolve him of responsibility.

The ruling is a stark reminder that even celebrities need to stay informed about their finances.

How Much Did Rupert Grint Earn?

Rupert Grint's tax bill also shines a spotlight on the financial success he achieved through Harry Potter. Appearing in all eight films, Grint reportedly earned around $30 million for his role as Ron Weasley. His company, Clay 10 Limited, was established in 2011 and has since amassed equity worth over $34 million.

Despite this financial cushion, Rupert Grint's tax bill of $2.3 million is no small burden. It also is not Grint’s first run-in with HMRC. In 2019, he lost another case involving a $1 million tax refund. These repeated challenges suggest an ongoing struggle with navigating the complexities of celebrity wealth and taxation.

Rupert Grint’s tax bill is a cautionary tale for anyone managing substantial earnings. For celebrities, whose income often includes royalties and residuals, the lines between income and capital gains can blur. However, as this case illustrates, relying too heavily on advisors without understanding the basics can lead to costly outcomes.